Disbursement Write Down

The Disbursement Write Down routine allows the user to make adjustments to the dollar amount being charged to the Client for Disbursements. To make Disbursement adjustments, the user must first execute a query based on criteria pertaining to the Disbursement records that are to be adjusted. For example, to adjust Disbursements between December 01 and January 14, the user must use those details as criteria when entering their query. Once the query is executed, the query results will be displayed in the Disbursement Details section, and the user may then select from the results which Disbursements are to be adjusted. Note: Disbursement amounts can only be Written Down (i.e. decreased).

When the Disbursement Write Down routine is accessed from the eQuinox main menu, the screen shown below will be displayed.

Field Definition

The first two fields on this screen display the Journal Type (DSWD) and the Journal Number (1234).

Posting Date - The date on which the Disbursement amounts are being adjusted. The default is the current System Date, but this may be changed by making a selection from the Calendar provided.

Acct Period - The Month (in number format) and Year of the Firm's current Accounting Period. This field automatically defaults to the current Accounting Period. Note: Depending on the Firm's preferences (as indicated in the Firm Parameters routine), the user may be alerted with a message when posting the Disbursement adjustments, and asked to verify the Accounting Period; this is used to ensure that all transactions occur within the correct Accounting Period.

Note: - To return Disbursements from the first entry up to a specified date in the query results, the user can leave the first date field empty (i.e. useful if the date of the first Disbursement entry is unknown). To return Disbursements from a specified date up to the most recent entry in the query results, the user can leave the second date field empty. Also, to not limit the query results to within a specified date range, both date fields can be left blank.

Note: - To return Disbursements from the first entry up to a specified date in the query results, the user can leave the first date field empty (i.e. useful if the date of the first Disbursement entry is unknown). To return Disbursements from a specified date up to the most recent entry in the query results, the user can leave the second date field empty. Also, to not limit the query results to within a specified date range, both date fields can be left blank.

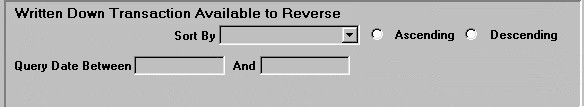

Sort By, Ascending, Descending - Before executing their query, the user must select the order in which the query results will be displayed (i.e. either Ascending or Descending), and the field by which this order will be determined (i.e. Tax Group, Transaction Date, etc).

Query Date Between X And X - The user must enter the dates representing the time period for which they wish to adjust Disbursement amounts. The dates can be selected from the Calendars provided.

Expenses - Disbursement Details

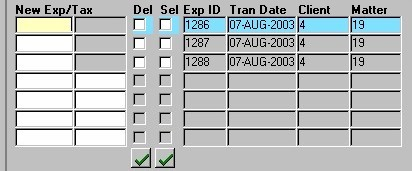

The screen sections seen below display the query results. From these records, the user must select the Disbursements records that are to be adjusted. The Disbursement information that is displayed is as entered in the Post WIP Disbursements routine, and cannot be edited by the user. Note: Since the records that are displayed in this section are all posted entries, they are displayed in grey.

New Disb/Tax - If the current record is being adjusted, the user must enter the new dollar amount to be charged to the Client for the Disbursements and for Taxes. Note: Disbursement Amounts can only be Written Down, so the new amounts must be less than the original amount.

Del - The Yes/No (checked/unchecked) value of this field indicates whether or not the current record is to be deleted. To select/deselect all records at once, the user can simply click the "Green Check Mark" button.

Sel - The Yes/No (checked/unchecked) value of this field indicates whether or not the Disbursement Amount for current record is to be adjusted. Since the default is 'checked', indicating that the record is to be adjusted, if the current record is not to be adjusted the user must 'uncheck' this field. To select/deselect all records at once, the user can simply click the "Green Check Mark" button.

Exp ID - The unique identifier for the current Disbursement record, as automatically assigned by the system.

Tran Date - The date on which the current Disbursement was entered into the system through the Post WIP Disbursements routine.

Client, Matter - The unique identifiers of the Client and Matter associated with the current Disbursement, as entered in the Post WIP Disbursement routine.

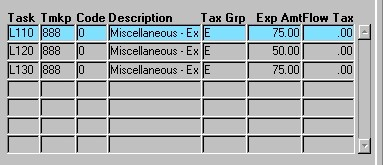

Task - The Task that applies to the current Disbursement (the cost was incurred while carrying out this task), as entered in the Post WIP Disbursement routine. NOTE: Task Codes are used in conjunction only with those Matters which are Billed on a Task Basis (a Task Template must be assigned in the Maintain Matter Information routine). If a Matter is not Billed on a Task Basis, this field will be left blank.

Tmkp - The unique identifier of the Timekeeper associated with the current Disbursement (the person who encountered the cost on behalf of the Client), as entered in the Post WIP Disbursement routine.

Code, Description - The code and description of the Disbursement, as entered in the Post WIP Disbursement routine.

Tax Grp - The name of the tax group that has been applied to the current Disbursement record.

Exp Amt, Flow Tax - The dollar amount currently being charged to the Client for the Disbursements/Expenses and Taxes, as entered in the Post WIP Disbursement routine (i.e. the original disbursement and tax amounts).

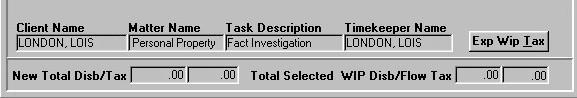

Client Name, Matter Name - The names of the Client and Matter associated with the current Disbursement, as entered in the Post WIP Disbursement routine.

Task Description - A description of the Task that applies to the current Disbursement (the cost was incurred while carrying out this task), as entered in the Post WIP Disbursement routine. Tasks are used in conjunction only with those Matters which are Billed on a Task Basis (a Task Template must be assigned in the Maintain Matter Information routine). If a Matter is not Billed on a Task Basis, this field will be left blank.

Timekeeper Name - The name of the Timekeeper associated with the current Disbursement (the person who encountered the cost on behalf of the Client), as entered in the Post WIP Disbursement routine.

Exp WIP Tax - To view and/or edit the WIP Taxes associated with the current Disbursement/Expense record, the user must click this button.

New Total Disb/Tax - The new totals for all Disbursement records, after the Disbursement and Tax amounts have been adjusted.

Total Selected WIP Disb/Flow Tax - The WIP Disbursement and Tax amounts taken from the records selected for adjustment.

Once the user has selected all the Disbursements that are to be adjusted, they must then click the Save button (or press F10). When the Disbursement adjustments are complete, the message seen on the left will be displayed to the user.